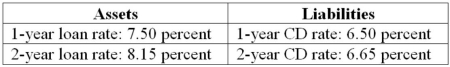

The following information is about current spot rates for Second Duration Savings' assets (loans) and liabilities (CDs) . All interest rates are fixed and paid annually.  If rates do not change, the balance sheet position that maximizes the FI's returns is

If rates do not change, the balance sheet position that maximizes the FI's returns is

Definitions:

Preferred Stock

A class of ownership in a corporation with a fixed dividend that must be paid out before dividends to common stockholders, and with generally no voting rights.

Callable

Describes a financial security that the issuer has the right to redeem or 'call back' before its maturity date, often at a predetermined price.

Preferred Stock

A class of ownership in a corporation with a higher claim on assets and earnings than common stock, typically with dividend payments that are prioritized over those of common stock.

Stock Listing

The inclusion of a company's shares on a stock exchange where they can be bought and sold by investors.

Q2: In the past, data availability limited the

Q19: The duration of a portfolio of assets

Q23: The chief compliance officer of a mutual

Q26: What refers to the risk that the

Q35: The underlying cause of foreign exchange volatility

Q39: Bank of the Atlantic has liabilities of

Q59: The expected loss potential is more difficult

Q76: The most common benchmark of relative size

Q76: The policyholder can vary the premium payments

Q88: First Duration, a securities dealer, has a