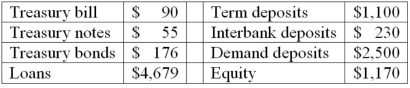

The numbers provided by Fourth Bank of Duration are in thousands of dollars.  Notes: All Treasury bills have six months until maturity. One-year Treasury notes are priced at par and have a coupon of 7 percent paid semiannually. Treasury bonds have an average duration of 4.5 years and the loan portfolio has a duration of 7 years. Term deposits have a 1-year duration and the Interbank deposits duration is 0.003 years. Fourth Bank of Duration assigns a duration of zero (0) to demand deposits. What is the bank's leverage adjusted duration gap?

Notes: All Treasury bills have six months until maturity. One-year Treasury notes are priced at par and have a coupon of 7 percent paid semiannually. Treasury bonds have an average duration of 4.5 years and the loan portfolio has a duration of 7 years. Term deposits have a 1-year duration and the Interbank deposits duration is 0.003 years. Fourth Bank of Duration assigns a duration of zero (0) to demand deposits. What is the bank's leverage adjusted duration gap?

Definitions:

Top Management

The highest level of management in an organization, responsible for strategic decisions and company-wide objectives.

Seven Stages

Seven Stages often refers to a predefined series of phases that describe a process or development in various contexts, requiring clarification in specific applications.

Personal Change

The process of transforming or modifying one's behavior, attitude, or life practices.

Pace of Change

The speed at which transformations occur in society, technology, or the environment.

Q12: Which of the following U.S. investment banks

Q14: The cumulative repricing gap position of an

Q15: An FI's most liquid asset is cash.

Q23: The chief compliance officer of a mutual

Q40: If the amount lost per dollar on

Q42: Banks whose loan portfolio composition deviates from

Q64: The function of institutional venture capital firms

Q67: Which of the following is NOT considered

Q74: Duration Bank has the following assets and

Q88: For an FI to exactly hedge the