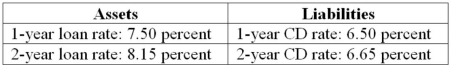

The following information is about current spot rates for Second Duration Savings' assets (loans) and liabilities (CDs) . All interest rates are fixed and paid annually.  If the FI finances a $500,000 2-year loan with a $400,000 1-year CD and equity, what is the leveraged adjusted duration gap of this position? Use your answer to the previous question.

If the FI finances a $500,000 2-year loan with a $400,000 1-year CD and equity, what is the leveraged adjusted duration gap of this position? Use your answer to the previous question.

Definitions:

Market Risk Premium

The extra return over the risk-free rate that investors require to compensate them for the risk of investing in the stock market.

Risky Investment

An investment that carries a high level of risk of loss, along with the potential for significant returns.

Risk-free Investment

An investment which is thought to have no risk of financial loss, though in reality, such an investment is virtually nonexistent.

Expected Rate of Return

The weighted average of all possible returns for an investment, accounting for the probability of each outcome.

Q7: In the LCD and EM debt markets,

Q8: According to Moody's Analytics, default correlations tend

Q18: In which of the following FX trading

Q34: What is the approximate yield on a

Q37: Which of the following is a weakness

Q51: Which of the following observations concerning floating-rate

Q65: The one-year CD rates for financial institutions

Q78: If foreign currency exchange rates are highly

Q81: The use of an exchange rate forward

Q104: Firm-specific credit risk can be eliminated by