During the current fiscal year, the following transactions (summarized) occurred in the Town of Berthoud Information Technology Internal Service Fund:

1. Employees were paid $290,000 wages in cash.

2. Utility bills received from the Town of Berthoud's Utility Fund during the year amounted to $23,500. The amount had previously been accrued by the Utility Fund.

3. Office expenses paid in cash during the year amounted to $10,500.

4. Service supplies purchased on account during the year totaled $157,500.

5. Parts and supplies used during the year totaled $152,300 (at cost).

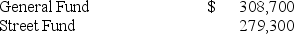

6. Charges to departments during the fiscal year were as follows:

7. Payments to the Utility Fund totaled $21,800.

8. Annual depreciation totaled $30,000 for machinery and equipment.

Prepare the journal entry. (If no entry is required for a transaction/event, select "No Journal Entry Required" in the first account field.)

Definitions:

Twisting Force

Also known as torque, it's the force that causes an object to rotate about an axis, fulcrum, or pivot.

Tightening Nuts

The process of securing nuts onto bolts or studs to a specified torque, ensuring a stable assembly.

Click-Type Torque Wrenches

Tools that make an audible click sound to signal when the pre-set torque level has been reached, ensuring proper tightening of bolts.

Lowest Possible Position

Refers to the minimal height or level something can be adjusted or positioned.

Q1: A revenues to expenditures ratio of over

Q6: A recognizable signal of fiscal stress is:<br>A)

Q16: To determine which costs are allowable for

Q23: In regard to pass-through grants, a recipient

Q23: Which of the following funds of a

Q24: The basis of accounting that should

Q37: According to the GASB, control of an

Q45: Only public colleges and universities are subject

Q52: The governmental funds category includes the General

Q62: Under a service concession arrangement, a government