Figure 18.3

Figure 18.3

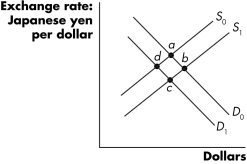

-Referring to Figure 18.3, the effect of an increase in Japanese interest rates is represented by a movement from point

Definitions:

Declaration Date

The date on which a firm’s directors issue a statement declaring a dividend.

Ex-Dividend Date

The date when the right to the dividend leaves the stock. This date was established by stockbrokers to avoid confusion and is two business days prior to the holder-of-record date. If the stock sale is made prior to the ex-dividend date, the dividend is paid to the buyer. If the stock is bought on or after the ex-dividend date, the dividend is paid to the seller.

Dividend Irrelevance Theory

A theory proposed by Franco Modigliani and Merton Miller that suggests that a company's dividend policy has no effect on its market value or investors' required yield.

Residual Distribution Policy

A policy where dividends are based on the earnings left over after all project and operational investments have been made.

Q3: Which approach to management communication is characterized

Q9: Referring to Figure 18.2, the peso is

Q17: Contemporary managerial communication stresses the importance of

Q31: When federal government spending exceeds tax revenues,

Q37: All of the following business leaders and

Q107: Checking accounts that pay interest are included

Q108: An open market sale by the Fed<br>A)

Q110: The one organization that has the power

Q111: Distinguish M1 from M2.

Q195: Refer to Figure 18.1. With free trade,