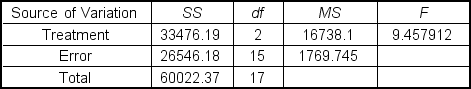

Medical Wonders is a specialized interior design company focused on healing artwork. The CEO, Kathleen Kelledy, claims that artwork has healing effects for patients staying in a hospital, as measured by reduced length of stay. Her current client is a children's cancer hospital. Kathleen is interested in determining the effect of three different pieces of healing artwork on children. She chooses three paintings (a horse photo, a bright abstract, and a muted beach scene) and randomly assigns six hospital rooms to each painting. Analysis of Kathleen's data yielded the following ANOVA table:  Using = 0.05, the observed F value is ___.

Using = 0.05, the observed F value is ___.

Definitions:

Ordinary Income

Income earned from providing services or the sale of goods, typically subject to standard tax rates, as opposed to income classified as capital gains.

Equipment Distribution

The process of supplying equipment to various departments or locations within an organization or among individuals.

Cash Distributions

Payments made in cash by a corporation to its shareholders, typically from earnings or profits.

Tax-exempt Income

Income that is not subject to federal income tax, such as certain interest income from municipal bonds.

Q2: Which of the following is not a

Q5: Suppose the population of all colleges shows

Q9: In a decision-making under risk scenario, the

Q27: Suppose for a given data set the

Q28: If the populations are normally distributed but

Q32: According to the central limit theorem,

Q36: The _ statement is used to create

Q39: Suppose a population has a mean of

Q50: A study is going to be conducted

Q59: The probability that a student will pass