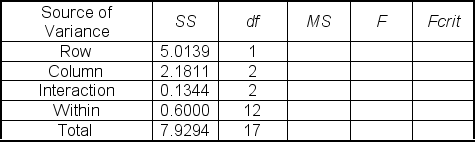

Complete the following two-factor ANOVA table. Determine the critical F values and reach conclusions about the hypotheses for effects at 5% significance level.

Definitions:

Marijuana

A mind-altering substance obtained from the Cannabis plant, utilized for either therapeutic or leisure activities.

Contextual Factors

Aspects of the environment or situation that influence the outcome of a process or behavior.

Pubertal Timing

Refers to the timing at which an individual begins experiencing the physical changes associated with puberty, which can impact psychological and social development.

Decision Making

The cognitive process of selecting a course of action from among multiple alternatives, often involving judgement and evaluation of risks and benefits.

Q2: Pinky Bauer, Chief Financial Officer of Harrison

Q9: When will the following loop terminate?<br>While keep_on_going

Q17: A researcher is conducting a matched?pairs study.

Q25: Your company is evaluating two cloud-based

Q32: A software developer is the person with

Q37: The normal distribution is used to test

Q37: In a chi-square goodness-of-fit test, theoretical frequencies

Q39: Medical Wonders is a specialized interior

Q49: The z value associated with a two?sided

Q57: The least squares regression equation for the