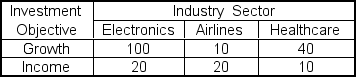

Anita Cruz recently assumed responsibility for a large investment portfolio. She wonders whether industry sector influences investment objective. Her staff prepared the following contingency table from a random sample of 200 common stocks:  Using =.01, appropriate decision is ___.

Using =.01, appropriate decision is ___.

Definitions:

Beta

An indicator of the level of systematic risk or volatility of a security or a portfolio relative to the entire market.

Total Risk

The complete range of risks associated with an investment, including both systematic risk (market related) and unsystematic risk (company or industry specific).

Standard Deviation

A measure of the dispersion or variability of a set of data points from its mean, often used in finance to gauge investment risk.

Risk Premium

The extra return above the risk-free rate that investors require to compensate them for holding a risky asset.

Q4: A researcher wants to estimate the percent

Q9: The following residuals plot indicates _. <img

Q11: A researcher believes a new diet should

Q15: Cindy Ho, VP of Finance at

Q27: The code for a function is known

Q29: The z value associated with a two-sided

Q37: A carload of steel rods has arrived

Q49: If the variances of the two

Q62: The decision rule in a chi-square goodness-of-fit

Q66: Which of the following functions returns the