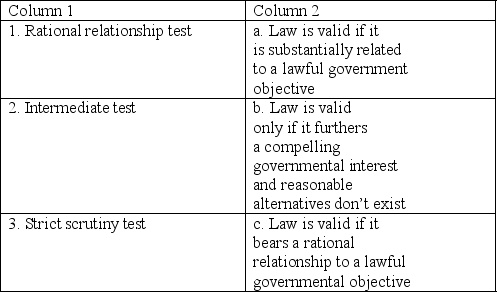

Matching:

-Match the standard of review in Column 1 to the description in Column 2.

Definitions:

Mispriced Securities

Financial instruments whose market prices deviate from their fair values due to various factors like information asymmetry or market inefficiencies.

Treynor-Black Model

A portfolio optimization model that blends a risky asset portfolio optimized for maximum Sharpe ratio with a risk-free asset.

Full Diversification

The process of spreading investments across various assets to reduce exposure to risk from any single asset.

Nonsystematic Risk

The risk associated with an individual investment or a small group of investments, which can be mitigated through diversification.

Q2: Which of the following agencies was NOT

Q3: Which is true about the variance for

Q14: Which of the following first developed the

Q15: The Freedom of Information Act (FOIA)permits for

Q17: Which of the following is an example

Q34: Due process cost-benefit analysis focuses on the

Q40: Which amendments to the U.S.Constitution require the

Q41: What will the reviewer assess when critically

Q49: The Tucker Act gives the U.S._Court jurisdiction

Q58: Any time that a law is enacted