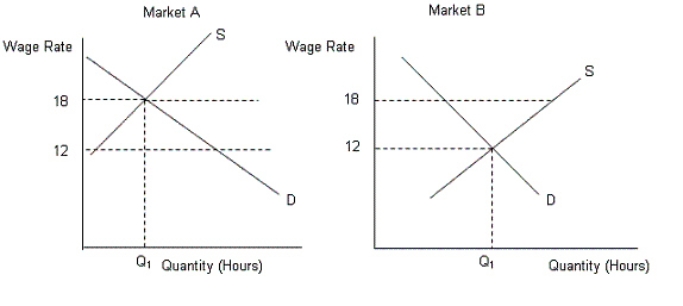

The figures given below show the demand (D) and supply (S) curves of labor in two different markets. Figure 15.3

-Refer to Figure 15.3.If the wage rates in market A and market B were set at $15,then:

Definitions:

Withholding Base

This term represents the amount of an individual's income that is subject to tax withholding by employers, determining the portion of income that will have taxes withheld in advance.

Directly Tipped Employee

An employee who receives tips directly from customers for services rendered, often subject to different tax reporting requirements.

Form 8027

A tax form used by employers who operate large food or beverage establishments to report tips received by employees.

FICA Tax

Federal Insurance Contributions Act tax, a payroll tax deducted from employees' wages for Social Security and Medicare benefits.

Q12: The major problem with common ownership is

Q27: An automobile manufacturer uses land,labor,capital,and entrepreneurial ability

Q28: Which of the following statements about Medicare

Q35: Fees paid to the mutual fund manager

Q38: The theory of comparative advantage is based

Q54: If the tax rate increases with an

Q72: If a person is earning $80,000 per

Q81: An imposition of tax by the government

Q91: Consider a perfectly competitive firm that can

Q94: The following table shows the marginal productivity