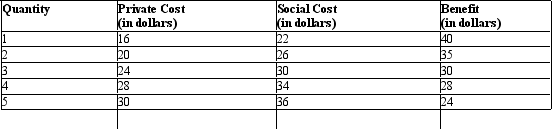

The following table shows the costs and benefit of producing a commodity. Table 13.1

-According to Table 13.1,at the social equilibrium:

Definitions:

Option

A financial derivative that gives the holder the right, but not the obligation, to buy or sell an asset at an agreed-upon price within a certain period.

Strike Price

The pre-determined price at which the holder of an option can buy (in the case of a call option) or sell (in the case of a put option) the underlying asset.

Exercise Value

The value of an option if it were exercised today, essentially representing the difference between the option’s strike price and the underlying asset's current price.

Call Options

A financial contract that gives the buyer the right, but not the obligation, to buy an asset at a specified price within a specified time frame.

Q2: Which of the following factors helps to

Q8: Assume that the firm described in

Q24: Assume the price facing the firm in

Q37: If a monopolistically competitive industry is in

Q44: For any particular period of time,say a

Q49: According to Figure 9.5,the firm has:<br>A)profits equal

Q65: Which of the following statements is true

Q73: The three phases of antitrust policy in

Q94: Strategic interdependence occurs in:<br>A)perfect competition.<br>B)monopoly.<br>C)monopolistic competition.<br>D)oligopoly.<br>E)local monopoly.

Q105: The quantity of labor supplied by a