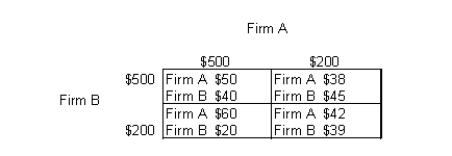

The table below shows the payoff (profit) matrix of Firm A and Firm B indicating the profit outcome that corresponds to each firm's pricing strategy (where $500 and $200 are the pricing strategies of two firms).Table 12.2

-Perfect competition is the only market structure in which firms are economically efficient in the long run.

Definitions:

Systematic Risk

This refers to the inherent risk that affects the entire financial market or a whole market segment, unpreventable through diversification.

Benchmark Risk

The risk that a portfolio's performance deviates from its benchmark index.

Portfolio Difference

The distinct variations and diversifications in an investment portfolio that aim at minimizing risk and maximizing returns.

Alpha

A measure of investment performance on a risk-adjusted basis, representing the excess return of an investment relative to the return of a benchmark index.

Q2: Average total cost is calculated by dividing:<br>A)the

Q22: Assume that the marginal revenue curve intersects

Q38: If there is imperfect competition in the

Q57: A firm whose price is below its

Q58: A market is said to be concentrated

Q59: Graphically,profit per unit of output can be

Q72: For a monopolist with a linear demand

Q74: Both monopolistically and perfectly competitive firms earn

Q117: When practicing price discrimination,a firm can increase

Q124: Which of the following is true of