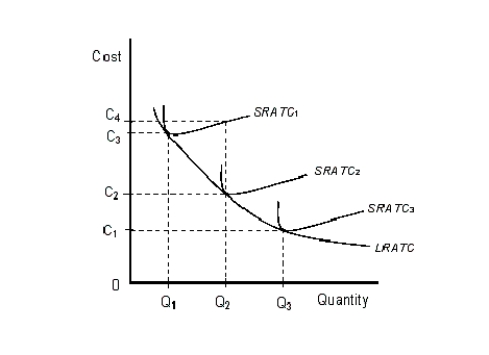

The figure given below shows three Short Run Average Total Cost (SRATC) curves and the Long Run Average Total Cost (LRATC) curve of a firm.Figure 8.3

-The minimum efficient scale is same across all industries irrespective of the types of goods they produce.

Definitions:

Passive Loss Rules

Tax regulations that limit the amount of passive activity losses (from investments in which the taxpayer does not materially participate) that can be deducted in a given year.

Materially Participates

In terms of tax law, an individual's active and regular involvement in the operations of a business, affecting eligibility for certain tax deductions.

Passive Activity

Economic activities in which the taxpayer does not materially participate, often producing income subject to special tax rules.

Materially Participate

Involvement in the operations of a business or activity in a regular, continuous, and substantial way, affecting the tax consequences.

Q1: In Table 8.2,assume that Holmes's total fixed

Q28: Which of the following will invariably be

Q29: Refer to Figure 6.2.Which of the

Q53: According to the circular flow of income,households

Q56: Profit is the difference between:<br>A)total output and

Q75: Opportunity cost is best defined as:<br>A)the sum

Q81: The market demand curve is derived by

Q84: Refer to Figure 4.1.The demand for

Q101: If a 10 percent increase in the

Q106: If the demand for liquor is elastic,and