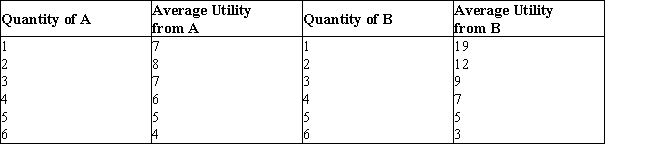

The below table shows the average utility (in utils) obtained from the consumption of goods A and B.Table 7.3

-It is often observed that, over the same period of time and for the same good, marginal utility declines rapidly for some consumers and very little for others. This observation illustrates:

Definitions:

General Sales Taxes

A tax imposed on sales transactions, usually calculated as a percentage of the sales price and collected by the seller at the point of purchase.

Personal Income Taxes

Taxes levied on the income of individuals, typically graduated so that higher income levels are taxed at higher rates.

Progressive

Describes a tax system where the tax rate increases as the taxable base amount increases, typically aimed at reducing income inequality.

Proportional

Having a constant relation in degree or number between two or more variables.

Q30: Marginal utility is _.<br>A)always greater than total

Q40: Refer to Figure 8.4.The profit maximizing level

Q47: A firm wishing to maximize profits will

Q56: When more and more units of a

Q64: A firm gets less efficient as it

Q70: Which of the following situations is represented

Q78: A perfectly inelastic demand curve is represented

Q87: In the oil tanker industry,large companies have

Q107: If a 1 percent change in the

Q125: Marginal utility is total utility divided by