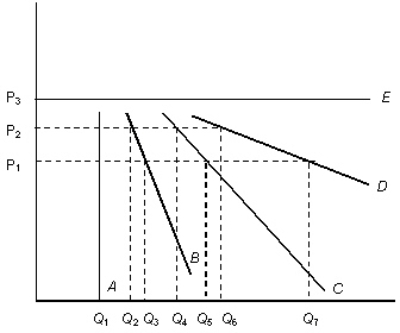

The figure given below shows the demand curves for five products: A,B,C,D,andE. Figure 5.1

- Refer to Figure 5.1.The value of the coefficient of price elasticity of demand for E is:

Definitions:

M&M Proposition II

Modigliani and Miller's Proposition II states that a company's cost of equity increases as it increases its leverage due to the risk premium on equity.

Debt-Equity Ratio

A financial ratio that measures the relative proportion of shareholders' equity and debt used to finance a company's assets.

Financial Risk

The chance of incurring a loss in capital in an investment or business operation.

Business Risk

The potential for losses or less-than-expected profits within the operations of a company, not related to financial debt but to the business's environment and operations.

Q27: Which of the following is not physical

Q46: Firms under perfect competition produce:<br>A)homogeneous products.<br>B)unique products.<br>C)either

Q46: When the income elasticity of demand for

Q56: When marginal utility is negative,total utility is

Q68: Which of the following is a defining

Q73: The long-run average-total-cost curve is U-shaped because:<br>A)a

Q85: Which of the following is true of

Q90: A perfectly competitive firm charges a price

Q100: Assume that as the price of wheat

Q101: The different combinations of any two goods