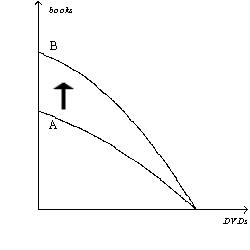

Figure 2-10

-Refer to Figure 2-10.The shift of the production possibilities frontier from A to B illustrates

Definitions:

Tax Burden

The measure of the total amount of taxes that individuals, businesses, or other entities must pay, relative to their income or profits.

Tax Revenues

The income that is gained by governments through taxation, which is used to fund public services, government obligations, and goods.

Benefits Principle

A concept that suggests taxes should be levied based on the benefits received by taxpayers, ensuring that those who benefit more from public services pay more taxes.

Ability-To-Pay Principle

The ability-to-pay principle is a tax theory suggesting that taxes should be levied based on the taxpayer’s capacity to pay, implying that wealthier individuals should pay more in taxes.

Q6: Refer to Figure 2-10. Which of the

Q30: Refer to Table 3-2. Assume that Aruba

Q136: Assumptions can simplify the complex world and

Q154: Which of the following is not an

Q177: In the circular-flow diagram, one loop represents

Q202: When a relevant variable that is not

Q343: An increase in the marginal cost of

Q425: For an economist, the idea of making

Q440: Refer to Figure 2-9, Panel (a). Production

Q522: Economists face an obstacle that many other