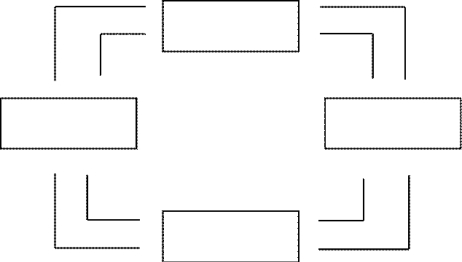

Using the outline below, draw a circular-flow diagram representing the interactions between households and firms in a simple economy. Explain briefly the various parts of the diagram.

Definitions:

Tax Distortion

Describes how taxes can alter market behavior and lead to efficiency loss compared to an untaxed market.

Optimal Taxation

The theory or practice of determining the most efficient and effective way of levying taxes to generate government revenue with minimal economic distortion or inefficiency.

Excess Burden

The societal expense resulting from market inefficiency, which arises when supply and demand are not in balance.

Progressive

A term often used in the context of taxation or political ideology, indicating policies or stances that aim to redistribute resources from the more affluent to the less affluent.

Q83: Economists build economic models by<br>A)generating data.<br>B)conducting controlled

Q110: Refer to Table 3-12. Assume that the

Q138: Economists who are primarily responsible for advising

Q210: Refer to Figure 3-11. If the production

Q229: Refer to Table 3-5. Spain should export<br>A)cheese

Q274: Refer to Figure 2-6. If this economy

Q282: Economists view normative statements as<br>A)prescriptive, making a

Q409: Refer to Figure 2-3. Inefficient production is

Q431: Ben bakes bread and Shawna knits sweaters.

Q488: The circular flow model is not used