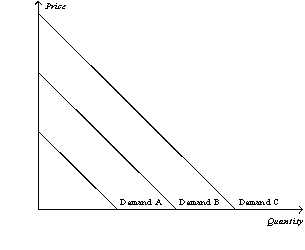

Figure 4-4

-Refer to Figure 4-4.Which of the following would cause the demand curve to shift from Demand A to Demand B in the market for oranges in the United States?

Definitions:

Zero Coupon Bonds

Bonds that do not pay periodic interest payments and are instead sold at a discount from their face value and redeemed at maturity for the full face value.

Coupon Payments

Periodic interest payments made to bondholders, usually on an annual or semi-annual basis, as compensation for investing in the bond.

Maturity Risk Premium

The additional return that investors demand for bearing the risk associated with holding a longer-term debt instrument.

Yield Curve

A graphical representation showing the relationship between the interest rates of bonds of identical quality but different maturity dates.

Q132: Refer to Figure 4-15. At what price

Q141: Refer to Figure 3-11. For Bonovia, what

Q213: Refer to Figure 3-9. If the production

Q217: Refer to Table 3-5. At which of

Q233: A farmer has the ability to grow

Q249: Lead is an important input in the

Q275: Refer to Table 4-9. Suppose Harry, Darby,

Q375: Refer to Table 3-9. Barb's opportunity cost

Q402: Refer to Table 4-2. Whose demand does

Q475: Advances in production technology typically reduce firms'