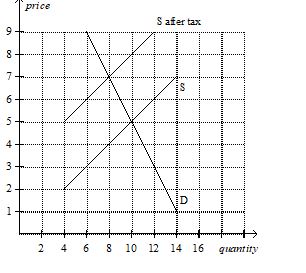

Using the graph shown, answer the following questions.

a. What was the equilibrium price in this market before the tax?

b. What is the amount of the tax?

c. How much of the tax will the buyers pay?

d. How much of the tax will the sellers pay?

e. How much will the buyer pay for the product after the tax is imposed?

f. How much will the seller receive after the tax is imposed?

g. As a result of the tax, what has happened to the level of market activity?

a.What was the equilibrium price in this market before the tax?

b.What is the amount of the tax?

c.How much of the tax will the buyers pay?

d.How much of the tax will the sellers pay?

e.How much will the buyer pay for the product after the tax is imposed?

Definitions:

Gestalt

A psychological approach emphasizing the holistic and innate patterns of perception and problem-solving as opposed to analyzing components individually.

Temperament

An individual's inherent personality traits and predispositions that influence their thoughts, behaviors, and interactions from an early age.

Sad Film

A movie genre designed to induce emotional responses, specifically feelings of sadness, in its audience.

Set Point

A theory suggesting that the body regulates certain variables, such as body weight or temperature, at a particular set point or equilibrium, making it resist change from this point.

Q1: Ray buys a new tractor for $118,000.

Q118: Economic policies often have effects that their

Q121: If the government passes a law requiring

Q136: Refer to Figure 6-20. Which of the

Q176: In 1776, the American Revolution was sparked

Q271: Total surplus in a market will increase

Q288: When policymakers are considering a particular action,

Q374: If the current allocation of resources in

Q413: Refer to Figure 7-14. Total surplus amounts

Q555: A minimum wage that is set below