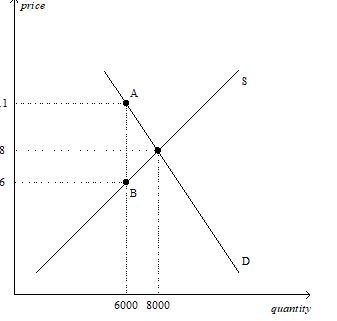

Using the graph shown, in which the vertical distance between points A and B represents the tax in the market, answer the following questions.

a. What was the equilibrium price and quantity in this market before the tax?

b. What is the amount of the tax?

c. How much of the tax will the buyers pay?

d. How much of the tax will the sellers pay?

e. How much will the buyer pay for the product after the tax is imposed?

f. How much will the seller receive after the tax is imposed?

g. As a result of the tax, what has happened to the level of market activity?

a.What was the equilibrium price and quantity in this market before the tax?

b.What is the amount of the tax?

c.How much of the tax will the buyers pay?

d.How much of the tax will the sellers pay?

e.How much will the buyer pay for the product after the tax is imposed?

Definitions:

Restraints of Trade

Legal restrictions or conditions that limit the freedom of businesses or individuals to conduct their trade or business activities unimpeded.

Celler-Kefauver Act

A United States antitrust law passed in 1950, aimed at prohibiting certain types of corporate mergers and acquisitions that reduce competition.

Antitrust Laws

Legislation (including the Sherman Act and Clayton Act) that prohibits anticompetitive business activities such as price fixing, bid rigging, monopolization, and tying contracts.

Interlocking Directorates

The practice of sharing board members among different companies, which can lead to conflicts of interest and anticompetitive behavior.

Q37: Efficiency in a market is achieved when<br>A)a

Q61: A drought in California destroys many red

Q175: Refer to Table 7-4. If you have

Q216: Efficiency is attained when<br>A)total surplus is maximized.<br>B)producer

Q262: Refer to Figure 7-19. At equilibrium, total

Q323: The lower the price, the lower the

Q335: Refer to Figure 6-18. The price paid

Q380: Suppose Raymond and Victoria attend a charity

Q382: A tax on sellers shifts the supply

Q520: Suppose there is currently a tax of