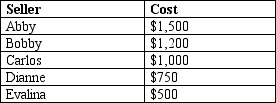

Table 7-7

The following table represents the costs of five possible sellers.

-Refer to Table 7-7.Who is a marginal seller when the price is $1,200?

Definitions:

Outstanding Stock

The total number of a company's shares that are currently owned by investors, including restricted shares.

Acquisition-Date

Represents the moment when one entity obtains control over another, marking a significant event for accounting and financial reporting.

Fair Value Allocation

Fair Value Allocation involves the process of assigning the fair value to the assets and liabilities of a company, especially during an acquisition, for financial reporting purposes.

Amortization

The process of spreading the cost of an intangible asset over its useful life, thereby reducing a company's taxable income.

Q87: Refer to Figure 7-21. Sellers whose costs

Q88: A tax of $0.25 is imposed on

Q90: The impact of the minimum wage depends

Q236: If a tax shifts the demand curve

Q252: Which of the following will cause an

Q308: Refer to Figure 8-5. After the tax

Q330: Consumer surplus is the amount a buyer

Q387: If a good or service is sold

Q389: Refer to Figure 8-4. The per-unit burden

Q509: How is the burden of a tax