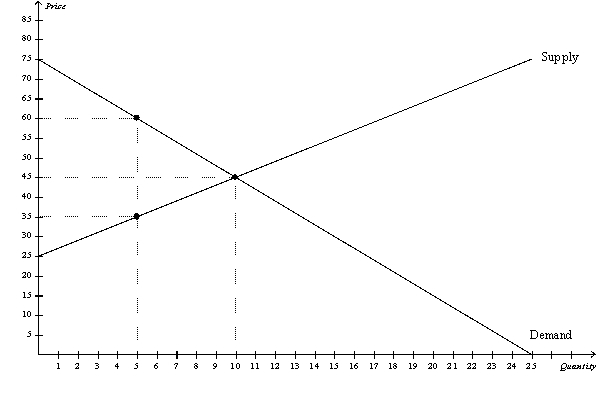

Figure 7-15

-Refer to Figure 7-15.At the equilibrium price,producer surplus is

Definitions:

Excise Tax

is a tax directly levied on certain goods, services, or activities, often with the intent to reduce their consumption or generate revenue.

Market Price

The current price at which a good or service can be bought or sold in a given market, reflecting supply and demand dynamics.

Tax Revenue

The wealth gathered by governments by imposing taxes.

Excise Tax

A tax levied on specific goods or commodities produced or sold within a country.

Q20: When the supply of a good increases

Q26: Refer to Figure 6-26. A price ceiling

Q140: If the size of a tax increases,

Q192: Which of the following is not correct?<br>A)Market

Q208: The burden that results from a tax

Q224: The loss in total surplus resulting from

Q336: Refer to Figure 7-2. When the price

Q360: Refer to Figure 7-22. At the quantity

Q402: Refer to Table 7-6. You have four

Q452: Price floors are typically imposed to benefit