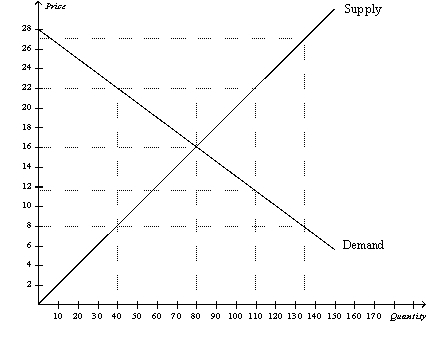

Figure 7-18

-Refer to Figure 7-18.Assume demand increases and as a result,equilibrium price increases to $22 and equilibrium quantity increases to 110.The increase in producer surplus to producers already in the market would be

Definitions:

Depreciable Equipment

Tangible assets used in operations that lose value over time due to wear and tear, which can be written off as an expense for tax purposes over its useful life.

Net Income

The ultimate profit a company makes, determined by taking away all expenses, taxes, and costs from the total income generated.

Cash Outflow

The total amount of money being transferred out of a business, including expenses, investments, and other payments.

Marginal Tax Rate

The rate of tax income of an additional dollar of income.

Q88: A tax of $0.25 is imposed on

Q98: Refer to Figure 7-9. If the supply

Q142: Refer to Figure 7-10. If the equilibrium

Q145: Refer to Figure 8-4. The equilibrium price

Q169: A tax levied on the buyers of

Q199: Refer to Figure 7-20. If 6 units

Q261: Refer to Figure 7-13. If the price

Q347: Refer to Figure 8-6. What happens to

Q386: Consumer surplus can be measured as the

Q452: Chuck would be willing to pay $20