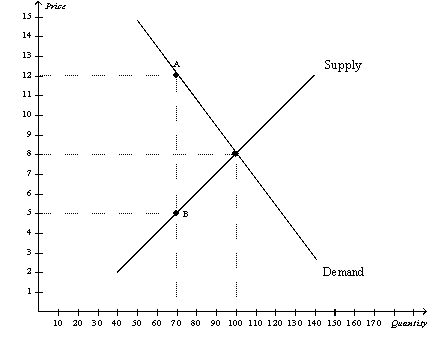

Figure 8-4

The vertical distance between points A and B represents a tax in the market.

-Refer to Figure 8-4.The tax results in a loss of consumer surplus that amounts to

Definitions:

Producer Surplus

The difference between what producers are willing and able to sell a good for and the actual price they receive, representing the benefit to sellers.

Opportunity Cost

The expense incurred by not choosing the second-best option in any decision-making process.

Higher Prices

An increase in the cost of goods or services in the market.

Quantities

The amount or number of a material or item present or available.

Q2: Refer to Figure 8-9. The imposition of

Q63: Refer to Figure 8-10. Suppose the government

Q64: Refer to Table 7-11. Both the demand

Q67: Refer to Figure 8-3. The amount of

Q69: Refer to Figure 9-7. The equilibrium price

Q77: Total surplus is represented by the area

Q111: To fully understand how taxes affect economic

Q126: Refer to Figure 7-17. When the price

Q346: Refer to Figure 9-7. Which of the

Q358: A tax levied on the sellers of