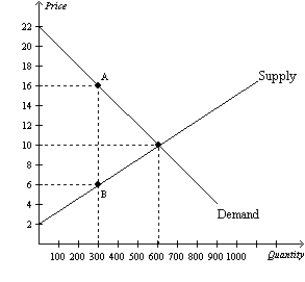

Figure 8-6

The vertical distance between points A and B represents a tax in the market.

-Refer to Figure 8-6.When the tax is imposed in this market,producer surplus is

Definitions:

Inelastic

Describes a situation where the demand or supply of a good or service is relatively unresponsive to changes in price.

Excise Tax

A tax levied on specific goods, services, or transactions, often included in the price of the product, such as alcohol, tobacco, and gasoline.

Borne

The bearing or enduring of costs, responsibilities, or consequences by an entity, often in the context of who ultimately pays for or suffers from economic decisions.

Progressive

A political and social philosophy advocating for reforms and innovations aimed at addressing inequalities and improving the welfare of the population.

Q5: If the world price of sugar is

Q34: When a country allows trade and becomes

Q86: After a country goes from disallowing trade

Q124: Refer to Figure 8-2. The per-unit burden

Q136: Refer to Figure 9-6. The amount of

Q201: Refer to Figure 8-1. Suppose the government

Q260: The benefit that government receives from a

Q328: Suppose that Firms A and B each

Q350: Refer to Figure 7-19. The equilibrium price

Q356: Total surplus in a market is equal