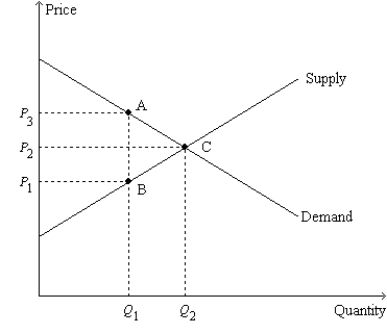

Figure 8-11

-Refer to Figure 8-11.Suppose Q1 = 4;Q2 = 7;P1 = $6;P2 = $8;and P3 = $10.Then,when the tax is imposed,

Definitions:

Total Revenue

The total income generated by a business from the sale of goods and services before any costs or expenses are deducted.

Price Decrease

refers to a reduction in the cost of a good or service, which can lead to an increase in demand due to the law of demand, assuming other factors remain constant.

Unit Elastic

A situation in which the percentage change in quantity demanded or supplied is equal to the percentage change in price.

Total Revenue

The total amount of money generated by the sale of goods or services before any costs are deducted.

Q6: Refer to Figure 8-2. The loss of

Q24: Refer to Figure 8-11. The deadweight loss

Q87: Refer to Figure 7-21. Sellers whose costs

Q91: A tax on a good causes the

Q92: Refer to Figure 8-3. The amount of

Q123: Refer to Figure 7-18. If 110 units

Q226: Refer to Figure 8-10. Suppose the government

Q275: Refer to Figure 9-6. The amount of

Q332: If T represents the size of the

Q411: Refer to Figure 8-4. The per-unit burden