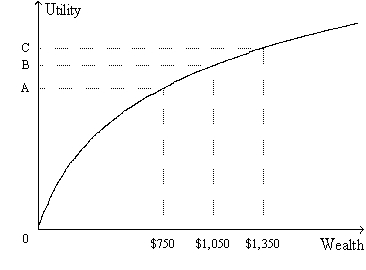

Figure 14-2. The figure shows a utility function for Mary Ann.

-Refer to Figure 14-2. Suppose Mary Ann begins with $1,050 in wealth. Starting from there,

Definitions:

Stock Price

The cost of buying a share of a company, which fluctuates based on market conditions and the performance of the company.

Naked Call Option

An options strategy where the investor sells call options without owning the underlying asset, exposing them to unlimited potential losses.

Potential Loss

The amount of money that could be lost in an investment or financial transaction under adverse conditions.

Call Premium

The amount by which the price of a call option exceeds its intrinsic value, reflecting the cost to purchase the option above its immediate exercise value.

Q37: A person who is not employed and

Q114: From the standpoint of the economy as

Q126: The Bureau of Labor Statistics places people

Q189: On a graph that depicts the market

Q191: Teenagers have more frequent unemployment spells so

Q202: If, for an imaginary closed economy, investment

Q224: Sheamous loses his job and decides to

Q224: You are better off choosing $400 in

Q384: You could borrow $2,000 today from Bank

Q521: The unemployment rate is computed as the