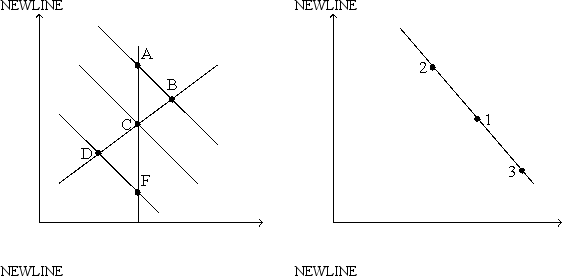

Figure 22-2

Use the pair of diagrams below to answer the following questions.

-Refer to Figure 22-2. If the economy starts at C and 1, then in the short run, an increase in government expenditures moves the economy to

Definitions:

Double Taxation

The imposition of two or more taxes on the same income, asset, or financial transaction.

Income Tax

Income tax is a tax levied by governments on individuals or entities based on their income or profits, with rates varying according to income levels.

Consumption

Households utilizing products and services for their needs.

Horizontal Equity

The principle that individuals with similar income and ability should be treated equally by the taxation system, ensuring fairness.

Q25: In general, the longest lag for<br>A)both fiscal

Q65: Suppose that consumers become pessimistic about the

Q113: Edward Prescott and Finn Kydland won the

Q154: Fiscal policy affects the economy<br>A)only in the

Q165: The idea that the long-run Phillips curve

Q186: Refer to Figure 21-5. A shift of

Q225: Refer to Figure 22-8. A movement of

Q257: An increase in the money supply shifts

Q333: If the minimum wage increased, then at

Q392: If a central bank decreases the money