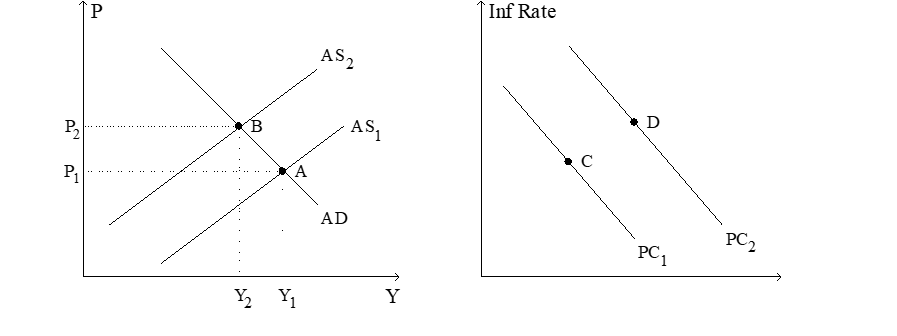

Figure 22-8. The left-hand graph shows a short-run aggregate-supply (SRAS) curve and two aggregate-demand (AD) curves. On the right-hand diagram, "Inf Rate" means "Inflation Rate."

-Refer to Figure 22-8. The shift of the aggregate-supply curve from AS1 to AS2

Definitions:

Temporary Difference

Differences between accounting income and taxable income that are expected to reverse in the future, affecting deferred tax calculations.

Permanent Difference

Transactions that cause a difference between the tax basis and the book value of assets and liabilities, which will not reverse over time.

Interperiod Tax Allocation

The process of allocating income taxes over different accounting periods due to temporary differences between financial accounting and tax reporting.

Intraperiod Tax Allocation

The process of allocating income taxes between different parts of the financial statements within the same fiscal period.

Q17: The national debt<br>A)exists because of past government

Q75: Which of the following are currently provisions

Q95: As an economist working for a U.S.

Q108: Refer to Figure 22-3. What is measured

Q166: A decrease in the growth rate of

Q196: Marcus is of the opinion that the

Q312: In the long run an increase in

Q327: If policymakers accommodate an adverse supply shock,

Q377: According to the Phillips curve, policymakers would

Q385: Other things equal, the higher the price