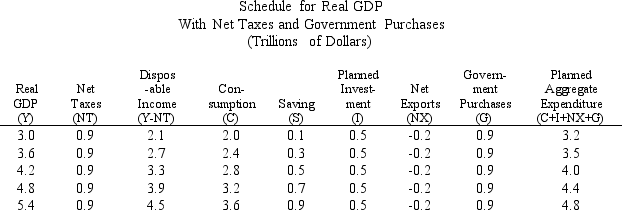

Exhibit 10-1

-In Exhibit 10-1, the government's budget is

Definitions:

Money Stock

The total amount of money in circulation within an economy at a given time, including cash and deposits.

Laffer Curve

A theoretical representation of the relationship between tax rates and government revenue, suggesting there is an optimal tax rate that maximizes revenue.

Marginal Tax Rates

A rephrased definition: The percentage of tax applied to your income for each tax bracket in which you qualify, essentially defining how much tax you pay on an incremental dollar of earnings.

Tax Revenues

Tax revenues are the income that is gained by governments through taxation, crucial for funding public services and governmental operations.

Q1: Which of the following statements about exports

Q10: Dennis spends $400 on a snowblower, expecting

Q24: Depreciation is subtracted from GDP to get

Q55: The marginal propensity to consume (MPC) in

Q62: Aggregate supply describes the relationship between<br>A)price level

Q99: Assume autonomous net taxes rise by $500;

Q104: GDP reflects many things; however, it does

Q122: The two basic markets in the simple

Q133: If the actual price level is less

Q162: The United States, with only one _