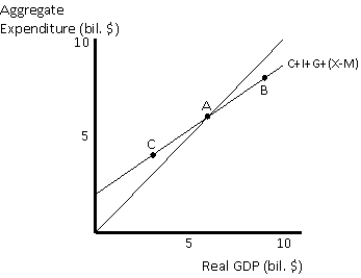

Exhibit 10-3

-Which of the following best describes the situation at point B in Exhibit 10-3?

Definitions:

Deductible Taxes

Taxes that can be subtracted from gross income to reduce taxable income, potentially lowering the amount of income tax owed.

Individual Returns

Individual returns refer to tax filings made by individual taxpayers, detailing income, deductions, and taxes owed or refunded.

Personal Property Tax

Taxes imposed on movable properties, such as vehicles and equipment, as opposed to real estate.

Deductible

An expense that can be subtracted from gross income to reduce the amount of income subject to tax, often related to business expenses, healthcare costs, and certain individual deductions.

Q12: In the short run, real and nominal

Q63: When a refrigerator worth $1,000 is produced

Q65: Stagflation is defined as<br>A)decreased output accompanied by

Q74: In Exhibit 9-2, the marginal propensity to

Q78: The life-cycle model<br>A)is an explanation of consumption

Q88: An increase in the price level will<br>A)shift

Q90: The owners of the Morning Glory Coffee

Q91: Labor productivity the United States has never

Q109: Classical economists believed that if investment were

Q199: Suppose this year's inflation rate is 4