Currently.the price of consuming housing  is lowered by the fact that home mortgage interest is tax deductible.Suppose the government proposed to eliminate this implicit subsidy of your housing consumption, raising the price from

is lowered by the fact that home mortgage interest is tax deductible.Suppose the government proposed to eliminate this implicit subsidy of your housing consumption, raising the price from  to

to  .At the same time, the government lowers the tax on other consumption, lowering the price from

.At the same time, the government lowers the tax on other consumption, lowering the price from  to

to  .

.

a.Write down your original budget constraint assuming the consumer has income I.

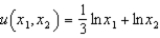

b.Suppose the utility function  captures your tastes, and suppose

captures your tastes, and suppose  ,

,  ,

,  ,

,  and

and  .Write out the utility maximization problem for this consumer prior to any policy change.

.Write out the utility maximization problem for this consumer prior to any policy change.

c.How much housing and other goods will this consumer consume prior to any policy change?

d.When the policy change goes into effect, will this consumer still be able to afford the bundle you derived in (c)?

e.When the policy change goes into effect, what bundle will the consumer consume?

Definitions:

Semiskilled Workers

Employees who have acquired a minimal level of specialized skills and training to perform specific tasks or jobs.

Skilled Workers

Individuals who have acquired special training, knowledge, and experience, often including formal education, necessary to perform complex tasks or trades.

Gilded Age

The period in U.S. history from the 1870s to about 1900, characterized by rapid economic growth, extravagant wealth for some, but also widespread poverty and corruption.

Gilded Age

A term describing the late 19th century in the United States, characterized by rapid economic growth, industrialization, and a marked disparity between rich and poor.

Q9: Every necessity is a normal good, but

Q15: When tastes are not quasilinear, the positive

Q15: Under which of the following monopoly pricing

Q15: It is usually more efficient to tax

Q30: Mary Green takes a summer course in

Q32: Suppose a monopolist produces a positive level

Q46: Imagine there are only two countries in

Q109: On average, about half the labor force

Q176: Suppose a basket of goods costs $400

Q206: Under the gold standard, all except one