Currently.the price of consuming housing  is lowered by the fact that home mortgage interest is tax deductible.Suppose the government proposed to eliminate this implicit subsidy of your housing consumption, raising the price from

is lowered by the fact that home mortgage interest is tax deductible.Suppose the government proposed to eliminate this implicit subsidy of your housing consumption, raising the price from  to

to  .At the same time, the government lowers the tax on other consumption, lowering the price from

.At the same time, the government lowers the tax on other consumption, lowering the price from  to

to  .

.

a.Write down your original budget constraint assuming the consumer has income I.

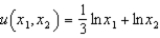

b.Suppose the utility function  captures your tastes, and suppose

captures your tastes, and suppose  ,

,  ,

,  ,

,  and

and  .Write out the utility maximization problem for this consumer prior to any policy change.

.Write out the utility maximization problem for this consumer prior to any policy change.

c.How much housing and other goods will this consumer consume prior to any policy change?

d.When the policy change goes into effect, will this consumer still be able to afford the bundle you derived in (c)?

e.When the policy change goes into effect, what bundle will the consumer consume?

Definitions:

Secure Attachment

A healthy emotional bond that forms between a child and caregiver, characterized by trust and a sense of safety.

Strange Situation

A procedure developed in psychology to observe attachment relationships between a caregiver and child.

Wary

Being cautious and alert to potential dangers or problems; having a sense of carefulness.

Toys

Objects designed for play, typically used by children to stimulate imagination and develop physical or cognitive skills.

Q5: Transaction costs are the costs incurred by

Q6: Expected utility functions have to be concave

Q6: Bottles of Coca-Cola and equally-sized bottles of

Q10: Suppose two economic models give the same

Q13: In a model of consumption and leisure,

Q19: In and Edgeworth Box economy, no one

Q22: If a pooling equilibrium exists in an

Q22: In the one-input model, the marginal product

Q26: For perfect complements, the (uncompensated) demand curve

Q30: Assuming upward sloping labor supply, wage subsidies