Currently.the price of consuming housing  is lowered by the fact that home mortgage interest is tax deductible.Suppose the government proposed to eliminate this implicit subsidy of your housing consumption, raising the price from

is lowered by the fact that home mortgage interest is tax deductible.Suppose the government proposed to eliminate this implicit subsidy of your housing consumption, raising the price from  to

to  .At the same time, the government lowers the tax on other consumption, lowering the price from

.At the same time, the government lowers the tax on other consumption, lowering the price from  to

to  .

.

a.Write down your original budget constraint assuming the consumer has income I.

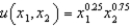

b.Suppose the utility function  captures your tastes, and suppose

captures your tastes, and suppose  ,

,  ,

,  ,

,  and

and  .Write out the utility maximization problem for this consumer prior to any policy change.

.Write out the utility maximization problem for this consumer prior to any policy change.

c.How much housing and other goods will this consumer consume prior to any policy change?

d.How much would this consumer be willing to pay to get the policy change implemented?

Definitions:

Leadership Development

Programs or processes designed to enhance the leadership skills, abilities, and effectiveness of individuals within an organization.

Double-Loop Learning

A learning process where not only are errors detected and corrected, but the underlying values and assumptions leading to the errors are also examined and modified.

Psychotherapy

A therapeutic intervention involving psychological methods, typically involving discussions, used to treat mental health problems or disorders.

Leadership Development

Programs or activities designed to enhance the skills, abilities, and knowledge of individuals to lead others effectively.

Q5: The purchasing power parity theory<br>A)is more a

Q8: You like bundle A better than bundle

Q9: Which of the following are true about

Q12: Suppose a firm is making zero long

Q15: Actuarily fair insurance reduces risk without changing

Q17: Leisure being a normal good is neither

Q25: If the rental rate increases, we know

Q37: If U.S. monetary authorities want to strengthen

Q76: In the balance of payments accounts, a

Q87: The purchasing power parity (PPP) theory suggests