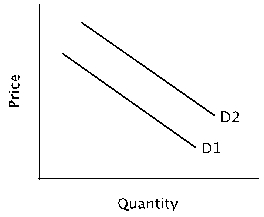

Refer to the figure below. Moving from demand curve D1 to demand curve D2 illustrates a(n) :

Definitions:

Taxable Income

The amount of an individual's or entity's income used to determine how much tax is owed, calculated by deducting allowable deductions from gross income.

Permanent Difference

A discrepancy between taxable income and accounting income that will not reverse over time, affecting the tax and financial reporting separately.

Life Insurance Proceeds

The money that beneficiaries receive from a life insurance policy upon the policyholder's death, typically exempt from income tax.

Interperiod Tax Allocation

The accounting technique of distributing tax expenses between different periods to match tax expenses with the revenues they are related to.

Q17: The entire group of buyers and sellers

Q19: The demand for cars in a certain

Q21: The _ appearance is the first court

Q32: What type of evidence is acknowledgement by

Q39: All of the following are examples of

Q51: What are the exceptions to the warrant

Q56: Larry was accepted at three different graduate

Q69: A market equilibrium:<br>A) is socially optimal.<br>B) leaves

Q111: Compared to the 1950-1973 period, output per

Q129: If Utopia has a closed economy, the