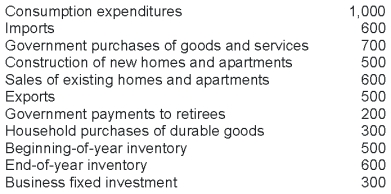

The following table provides data for an economy in a certain year.  Given the data in the table, compute the value of GDP.

Given the data in the table, compute the value of GDP.

Definitions:

Progressive Income Tax

A taxing mechanism in which the tax rate increases as the taxable amount or income increases, placing a higher burden on those who earn more.

Average Tax Rate

The ratio of the total amount of taxes paid to the taxpayer's total income, representing the percentage of income paid in taxes.

Marginal Tax Rate

The tax rate applied to the last dollar of income, representing the percentage of tax paid on any additional dollar of income.

Taxable Income

The portion of an individual's or entity's income used to calculate how much tax they owe to the government, after deductions and exemptions.

Q5: The discovery and utilization of vast, previously

Q8: Normative analysis:<br>A) addresses the question of whether

Q10: Each of the following statements describes how

Q10: The provision of additional cash to the

Q28: To correct a nominal quantity for changes

Q83: Protectionism is the view that free trade

Q87: A nominal value is measured:<br>A) in physical

Q137: Which of the following would be classified

Q149: Mike and Tom debone chicken breasts for

Q162: Countries with high real GDP tend to