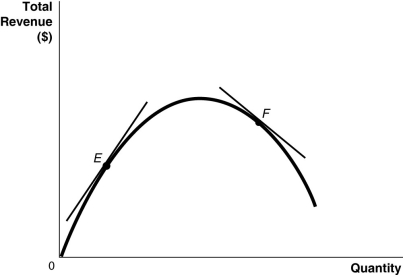

Figure 1-4

-Refer to Figure 1-4.Which of the following statements is false?

Definitions:

Buildings

Structures, typically permanent and of substantial size, constructed or adapted for various uses, including residential, commercial, or industrial purposes.

Depreciated

Depreciation refers to the accounting practice of spreading out the expense of a physical asset over the duration of its expected lifespan.

Tax Purposes

Considerations or actions taken within financial contexts to optimize tax liability, including strategies for deductions, credits, and structuring transactions.

CCA Rate

Refers to the Capital Cost Allowance rate, which is used in taxation to represent the annual depreciation expense of a physical asset's cost.

Q3: Which of the following best describes the

Q16: Which of the following arguments commits the

Q18: Which of the following is a way

Q34: The virtue ethicist claims that principles of

Q37: Which of the following is a fallacy

Q54: The supply curve for watches<br>A)shows the supply

Q148: In the circular flow model, households demand

Q158: When you purchase a bicycle you do

Q249: Adam Smith, the father of modern economics,

Q304: Indicate whether each of the following situations