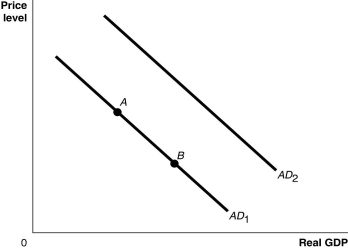

Figure 9.1  Alt text for Figure 9.1: In figure 9.1, a graph comparing real GDP and price level.

Alt text for Figure 9.1: In figure 9.1, a graph comparing real GDP and price level.

Long description for Figure 9.1: The x-axis is labelled, real GDP, and the y-axis is labelled, price level, with 0 at the vertex.Line AD1 begins in the top left corner and slopes down to the bottom center.Line AD2 follows the same slope as line AD1 but is plotted to the right.Points A and B are plotted along line AD1.Point A is a little less than half way along the left side of the line, and point B is little more than half way on the right side of the line.

-Refer to Figure 9.1.Ceteris paribus, an increase in interest rates would be represented by a movement from

Definitions:

Tax Authority

Governmental agencies responsible for the enforcement of tax laws and the collection of taxes.

Medicare

A federal health insurance program in the United States for people aged 65 and over, as well as for younger individuals with certain disabilities.

Health Care Insurance

An insurance policy that covers the cost of medical and surgical treatments for the policyholder.

Tax Rate

The percentage at which an individual or corporation is taxed, which can vary based on income level, type of earnings, and other factors.

Q66: Refer to Table 7.7.Consider the statistics in

Q92: What are inventories? What usually happens to

Q141: Refer to Figure 9.3.Ceteris paribus, an increase

Q145: Changes in _ do not affect the

Q154: Suppose there is a bank panic.Which of

Q160: Which of the following countries actually experienced

Q165: What is the formula for the multiplier?

Q242: Which of the following is a reason

Q248: Which of the following will cause a

Q276: M2 includes currency held outside banks plus<br>A)currency