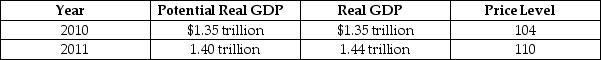

Table 11.2

-Refer to Table 11.2.The hypothetical information in the table shows what the values for real GDP and the price level will be in 2011 if the Bank of Canada does not use monetary policy:

a.If the Bank of Canada wants to keep real GDP at its potential level in 2011, should it use an expansionary policy or a contractionary policy? Should the trading desk buy c bonds or sell them?

b.Suppose the Bank of Canada's policy is successful in keeping real GDP at its potential level in 2011.State whether each of the following will be higher or lower than if the Bank of Canada had taken no action:

(i)Real GDP

(ii)Full-employment real GDP

(iii)The inflation rate

(iv)The unemployment rate

c.Draw an aggregate demand and aggregate supply graph to illustrate your answer.Be sure that your graph contains LRAS curves for 2010 and 2011; SRAS curves 2010 and 2011; AD curve for 2010 and 2011, with and without monetary policy actions; and equilibrium real GDP and the price level in 2011 with and without policy.

Definitions:

Ultimate Levels

Explanations in biology that address why events occur, based on evolutionary significance and history.

Sonograms

Visual representations of the spectrum of frequencies of sound as they vary with time, often used in bird song analysis.

Acoustic Stimulus

A sound or auditory signal that triggers a response in a receiver, commonly studied in animal communication and human psychology.

Genetic Differences

Variation in the DNA sequences among individuals or populations, which can influence traits, disease susceptibility, and adaptation to environmental changes.

Q19: For the purchasing power of money to

Q24: Why are the long-run effects of an

Q28: The expansionary monetary and fiscal policies of

Q40: One potential problem with cryptocurrency is<br>A)the value

Q73: Economies where goods and services are traded

Q77: In response to already low interest rates

Q101: The Bank of Canada plays a larger

Q169: If workers and firms expect that inflation

Q179: Which of the following is a function

Q192: Refer to Table 11.2.The hypothetical information in