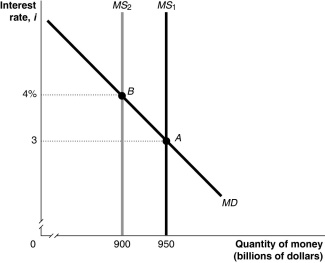

Figure 11.6  Alt text for Figure 11.6: In figure 11.6, a graph shows movement in the money market.

Alt text for Figure 11.6: In figure 11.6, a graph shows movement in the money market.

Long description for Figure 11.6: The x-axis is labelled, quantity of money, M (billions of dollars) , with values 900 and 950 marked.The y-axis is labelled, interest rate, i, with values 3 and 4% marked.3 lines are shown; MS1, MS2, and MD.Line MD begins in the top left corner and slopes down to the end of the x-axis.Line MS1 is perpendicular to the x-axis, and begins from the value 950.Line MS2 is perpendicular to the x-axis, and begins from the value 900, to the left of line MS1.Line MD intersects line MS1 at point A (950, 3) , approximately 3 quarters of the way along both lines.Line MD meets line MS2 at point B (900, 4%) , more than half way along both lines.These points of intersection are connected to their respective coordinates on the y-axis using dotted lines.

-Refer to Figure 11.6.In the figure above, the movement from point A to point B in the money market would be caused by

Definitions:

Blindness

The state or condition of being unable to see due to injury, disease, or a congenital condition.

Paralysis

The loss of the ability to move (and sometimes to feel anything) in part or most of the body, typically as a result of illness, poison, or injury.

Somatoform Disorders

A group of psychological disorders in which patients experience physical symptoms that have no identifiable physical cause.

Hypochondriasis

A psychological disorder wherein an individual is excessively worried about having a serious illness, often misinterpreting normal bodily functions as symptoms of serious conditions.

Q21: Monetary policy refers to the actions the<br>A)Prime

Q23: A one-time tax rebate, which is not

Q44: Monetarists think that the Bank of Canada

Q82: Which of the following is one of

Q120: Refer to Figure 12.12.If government purchases increase

Q142: The crowding out of private spending by

Q180: An increase in the money supply is

Q193: The short-run aggregate supply curve is vertical.

Q235: Canada followed the U.S.into recession in 2008,

Q269: The federal government debt _ when the