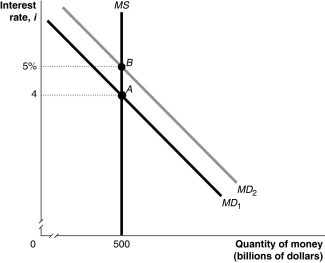

Figure 11.7  Alt text for Figure 11.7: In figure 11.7, a graph shows movement in the money market.

Alt text for Figure 11.7: In figure 11.7, a graph shows movement in the money market.

Long description for Figure 11.7: The x-axis is labelled, quantity of money, M (billions of dollars) , with value 500 marked.The y-axis is labelled, interest rate, i, with values 4 and 5% marked.3 lines are shown; MD1, MD2, and MS.Line MD1 begins in the top left corner and slopes down to the end of the x-axis.Line MD2 follows the same slope as line MD1, but is plotted to the right.Line MS is perpendicular to the x-axis, and begins from the value 500.Line MD1 meets line MS at point A (500, 4) , a little more than half way along both lines.Line MD2 meets line MS at point B (500, 5%) , approximately 3 quarters of the way along both lines.These points of intersection are connected to their respective coordinates on the y-axis using dotted lines.

-Refer to Figure 11.7.In the figure above, the movement from point A to point B in the money market would be caused by

Definitions:

Alternative Hypothesis

A statement in hypothesis testing that proposes a significant difference, effect, or relationship exists in the population, opposing the null hypothesis.

Test Statistic

A statistic whose calculated value is used to decide whether to reject the null hypothesis in a hypothesis test.

Population Distribution

The distribution of a characteristic within an entire population, described by parameters such as mean, variance, and standard deviation.

Null Hypothesis

A hypothesis that suggests there is no statistical significance between two variables, often used as a default hypothesis in testing.

Q2: A bank's reserves equal its<br>A)vault cash.<br>B)deposits with

Q4: Refer to Figure 12.6.In the dynamic model

Q61: A decrease in interest rates can _

Q96: Refer to Table 11.9.Suppose the table above

Q142: Refer to Figure 9.8.Given the economy is

Q180: Refer to Figure 11.12.In the figure above,

Q191: A cut in tax rates affects equilibrium

Q245: Federal government purchases, as a percentage of

Q258: The statement "this Harry Rosen tie costs

Q272: The federal government increased income tax deductions