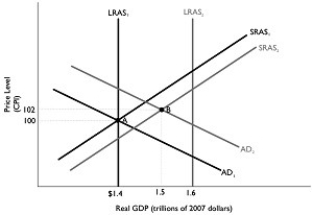

Figure 11.13  Alt text for Figure 11.13: In figure 11.13, a dynamic model of AD-AS.

Alt text for Figure 11.13: In figure 11.13, a dynamic model of AD-AS.

Long description for Figure 11.13: The x-axis is labelled, real GDP (trillions of 2007 dollars) , with values $1.4, 1.5, 1.6 marked.The y-axis is labelled, price level (CPI) , with values 100 and 102 marked.6 lines are shown; SRAS1, SRAS2, AD1, AD2, LRAS1, LRAS2.Line SRAS1 begins in the bottom left and slopes up to the top right corner.Line SRAS2 follows the same slope as line SRAS1, but is plotted to the right.Line AD1 begins at the top left corner and slopes down to the end of the x-axis.Line AD2 follows the same slope as AD1, but is plotted to the right.Line LRAS1 is perpendicular to the x-axis, and begins from the x-axis value $1.4.Line LRAS2 is perpendicular to the x-axis, and begins from the value 1.6.Line LRAS1 intersects line AD1 and SRAS1 at point A ($1.4, 100) .Lines AD2 and SRAS2 intersect at point B (1.5, 102) .Points A and B are connected to their respective coordinates on the x-axis and y-axis with dotted lines.Line LRAS2 intersects lines SRAS1 and SRAS2 on the right end of these lines.Similarly, line LRAS2 intersects lines AD1 and AD2 toward the right end of these lines.

-Refer to Figure 11.13.In the dynamic model of AD-AS in the figure above, if the economy is at point A in year 1 and is expected to go to point B in year 2, and the Bank of Canada pursues no policy, then at point B

Definitions:

Workers' Wages

The compensation or earnings paid to employees or laborers for their work or services, usually expressed in terms of hourly, daily, or monthly rates.

Reconstruction Finance Corporation

A government corporation in the United States created by Congress in 1932 to provide financial support to state and local governments and make loans to banks, railroads, mortgage associations, and other businesses.

Federal Loans

Long-term borrowing provided by the federal government to support students, businesses, and other entities, often with favorable terms.

Insurance Companies

Organizations that provide financial protection against specified risks in exchange for premiums.

Q47: As was demonstrated in 2007, firms in

Q71: The U.S.Federal Reserve and the US Treasury

Q77: Assume your marginal income tax rate is

Q113: Refer to Figure 11.8.In the figure above,

Q140: A bank's largest liability is its<br>A)short-term borrowing.<br>B)long-term

Q155: Refer to Table 12.2.Consider the hypothetical information

Q199: Suppose real GDP is $1.7 trillion, potential

Q206: Suppose real GDP is $1.6 trillion and

Q250: The multiplier effect refers to the series

Q267: Refer to Figure 11.3.In the figure above,