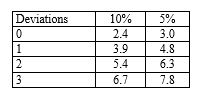

An auditor planning tests of controls specifies a risk of assessing control risk too low of 10 per cent and a tolerable deviation rate of six per cent and expects no deviations. For these specifications, the planned sample size should be: (Use the following table to determine your answer.)

Number of factors for sampling risks of:

Definitions:

Q4: Purchase cut-off procedures should be designed to

Q5: Which of these proteins is used less

Q11: When evaluating risks in accordance with the

Q13: Inquiry of the previous auditor is:<br>A) required

Q21: Tests of controls for the occurrence assertion

Q29: Which of the following functional groups are

Q35: Activation of amino acids<br>A) produces a pyrophosphate

Q51: Which statement is not correct about peptide

Q64: Specificity of aminoacyl-tRNA synthetases is always based

Q83: An aged trial balance of accounts receivable