Calculate the payback period for each of the following projects, then comment on the advisability of selection based on the payback period criterion in contrast to NPV: Project A has a cost of $15,000, returns $4,000 after-tax the first year and this amount increases by $1,000 annually over the five-year life; Project B costs $15,000 and returns $13,000 after-tax the first year, followed by four years of $2,000 per year.The firm uses a 10 percent discount rate.

B.So payback can seriously underestimate a Project's contribution to business wealth, as illustrated in its contrasting results to that of NPV.

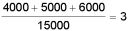

PaybackA:

years

years

PaybackB:

Definitions:

Anger at Home

Emotional responses of frustration or rage experienced within a domestic setting, often due to interpersonal conflicts or stress.

Coping Strategies

Techniques or actions used to manage stress, anxiety, or challenges in life.

Stress in Workplace

A condition resulting from workplace environments or demands that exceed an individual's coping abilities, potentially leading to health problems and decreased job performance.

Excessive Stress

A condition where an individual experiences an overwhelming amount of tension and pressure, surpassing their ability to cope effectively.

Q5: Which of the following is a characteristic

Q5: A company purchases equipment to be used

Q18: As the discount rate is increased, the

Q30: Protons and neutrons make up the atom's

Q59: Starch is the primary storage food for

Q63: Under which of the following conditions will

Q101: The term "constant dollars" refers to equal

Q107: What is the book value per share

Q115: The board of directors is dissatisfied with

Q134: A stock offers an expected dividend of