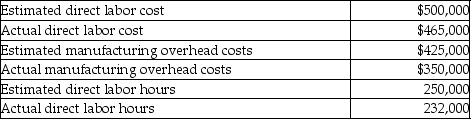

Federer Company is debating the use of direct labor cost or direct labor hours as the cost allocation base for allocating manufacturing overhead. The following information is available for the most recent year:  If Federer Company uses direct labor cost as the allocation base, what would the allocated manufacturing overhead be for the year?

If Federer Company uses direct labor cost as the allocation base, what would the allocated manufacturing overhead be for the year?

Definitions:

GST Remittance

This is the process of sending the collected Goods and Services Tax to the governing tax authority.

GST Returns

The periodic filing with the taxation authority detailing sales, the GST collected on sales, and the GST paid on purchases.

Correct To The Cent

Adjusting a monetary amount to ensure accuracy up to the smallest currency unit, often referring to rounding to the nearest cent.

Rate Of Return

The increase or decrease in the value of an investment within a defined timeframe, represented as a percent of the investment's initial price.

Q20: Anderson Enterprises uses a job costing system.

Q136: The gross profit on the sale of

Q137: Watson's Computer Company uses ABC to account

Q151: An accountant who does not understand "accrual

Q160: XYZ uses job costing. Actual manufacturing overhead

Q195: The difference between the sales price and

Q242: Wet N Wild Sports Equipment Company's work

Q242: Machine set-up would be considered a batch-level

Q266: The cost of direct labor used in

Q298: The first three steps to allocating manufacturing