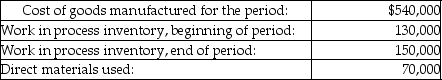

Here is some basic data for Morgenstern Company:  Manufacturing overhead is allocated at 70% of direct labor cost.

Manufacturing overhead is allocated at 70% of direct labor cost.

What are the total costs debited to work in process inventory during the period?

Definitions:

Direct Labor Costs

Expenses that can be directly traced to the production of goods or services, including wages of workers who are physically involved in creating a product.

Predetermined Overhead Rate

A rate calculated by dividing estimated overhead costs by an allocation base, used to apply overhead to products or services.

Materials Quantity Variance

The difference between the actual quantity of materials used in production and the expected (or standard) quantity, measured in financial terms.

Direct Materials

These are the raw materials that are directly incorporated into a finished product.

Q32: The journal entry needed to record the

Q95: In a job cost system, all costs

Q96: Kramer Company manufactures coffee tables and uses

Q134: Ryan's Paints allocates overhead based on machine

Q136: Rustic Living Furniture Company manufactures furniture at

Q143: Lean thinking typically focuses on strengthening supply-chain

Q187: Here is some basic data for Shannon

Q214: Here is some basic data for Bella

Q222: Which of the following product costing systems

Q240: Which term below best describes the quality