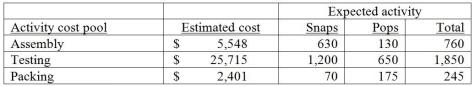

Alexander Inc. uses activity-based costing. The company produces two products: Snaps and Pops. The expected annual production of Snaps is 1,500 units, while the expected annual production of Pops is 2,200 units. There are three activity cost pools: Assembly, Testing, and Packing. The estimated costs and activities for each of these three activity pools follows:  The cost pool activity rate for Testing would be

The cost pool activity rate for Testing would be

Definitions:

Incorporation Statute

A law that governs the formation, operation, and dissolution of corporations, providing the legal framework for businesses to obtain corporate status.

De Facto Corporation

A corporation that operates like a legally incorporated company, despite not having completed all required incorporation steps, often recognized for legal purposes.

State Government

The government of a specific state in a federal system, responsible for local laws, policies, and management of state-specific issues.

Corporate Headquarters

Corporate headquarters refers to the main office or center of operations for a company, where key management and executive functions are performed.

Q33: Total variable costs can be expressed as

Q88: A company produces toy airplanes at a

Q128: Here are selected data for Sunny Sky

Q143: Perry Moldings has the following estimated costs

Q151: Total fixed costs for Randolph Manufacturing are

Q176: The two basic types of costing systems

Q199: Molding and sanding each unit of product

Q268: If there is little or no relationship

Q299: Twinkle Ornaments Company uses job costing. Twinkle

Q334: London Ceramics makes custom ceramic tiles. During