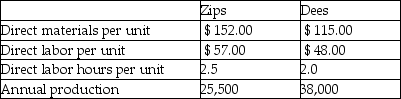

Cross Roads Manufacturing currently uses a traditional costing system. The company allocates overhead to its two products, Zips and Dees, using a predetermined manufacturing overhead rate based on direct labor hours. Here is data related to the company's two products:  Information about the company's estimated manufacturing overhead for the year follows:

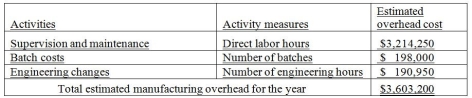

Information about the company's estimated manufacturing overhead for the year follows:  Total estimated direct labor hours for the company for the year are 110,000 hours.

Total estimated direct labor hours for the company for the year are 110,000 hours.

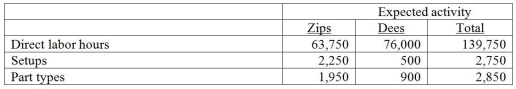

The company is evaluating whether it should use an activity-based costing system in place of its traditional costing system. Additional information about production needed for the activity-based costing system follows:  The amount of manufacturing overhead that would be allocated to one unit of Dees using an activity-based costing system would be closest to

The amount of manufacturing overhead that would be allocated to one unit of Dees using an activity-based costing system would be closest to

Definitions:

Q8: A paper mill company like International Paper

Q17: There will be little benefit to using

Q44: In a process system with multiple processes,

Q85: Which type of cost behavior is indicated

Q99: Yummy Tummy Desserts has 3,200 quarts of

Q110: Total variable costs change in direct proportion

Q133: Manufacturing overhead may include depreciation on the

Q232: External failure costs occur when the company

Q235: Ready Company adds direct materials at the

Q260: The total cost of a job shown