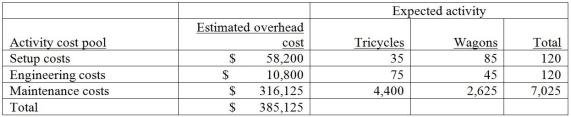

Columbia Corporation manufactures two products: Tricycles and Wagons. The annual production and sales of Tricycles is 2,200 units, while 1,750 units of Wagons are produced and sold. The company has traditionally used direct labor hours to allocate its overhead to products. Tricycles require 2 direct labor hours per unit, while Wagons require 1.5 direct labor hours per unit. The total estimated overhead for the period is $385,125. The company is looking at the possibility of changing to an activity-based costing system for its products. If the company used an activity-based costing system, it would have the following three activity cost pools:  Required:

Required:

a. Calculate the unit cost for a Wagon using the traditional system based on a single plantwide overhead rate (use direct labor hours as the cost driver).

b. Calculate the unit cost for a Wagon using the activity-based costing system.

Definitions:

Task Segmentation

The breaking down of a job or project into smaller, more manageable components or units for easier completion.

Tiffany/Walmart Strategy

A comparison of two distinct business models: Tiffany's high-end, luxury market positioning versus Walmart's focus on economies of scale, cost leadership, and broad market appeal.

Geographic Markets

Markets segmented based on geographic criteria like countries, states, regions, or cities where specific population characteristics influence marketing strategies.

Different Covers

A term that could imply various meanings such as alternate versions of book or album covers, but without specific context, it's unclear.

Q41: When units are moved from one processing

Q47: The Akron Slugger Company produces various types

Q94: Bilingsly Limited, a manufacturer of a variety

Q122: Best Birdies produces ornate birdcages. The company's

Q129: If production increases by 30%, how will

Q226: All of the following are considered to

Q236: The total cost of a job shown

Q241: Blossom Company has two sequential processing departments:

Q246: Total mixed cost graphs intersect the y-axis

Q273: Using account analysis, what type of cost