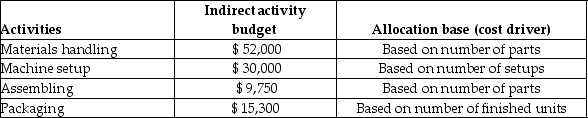

Watson's Computer Company uses ABC to account for its manufacturing process.  Watson's Computer Company expects to produce 2,250 computers. Watson's Computer Company also expects to use 13,000 parts and have 20 setups.

Watson's Computer Company expects to produce 2,250 computers. Watson's Computer Company also expects to use 13,000 parts and have 20 setups.

The allocation rate for packaging is

Definitions:

Medicare & Medicaid

Federal programs in the United States that provide health coverage; Medicare serves older adults and some younger disabled individuals, while Medicaid assists low-income people.

Progressive Tax Structure

A tax system in which the tax rate increases as the taxable amount or income increases, placing a heavier burden on those who can afford to pay more.

Marginal Tax Rate

The rate at which an additional dollar of income is taxed.

Vertical Equity

A principle in taxation that says taxpayers with a higher ability to pay should contribute more in taxes.

Q23: How is the cost of indirect labor

Q63: The mixing department has 18,000 units and

Q77: All manufacturers use either a pure process

Q88: A company produces toy airplanes at a

Q126: To find the "cost per equivalent unit,"

Q133: Manufacturing overhead may include depreciation on the

Q192: If conversion costs are added evenly throughout

Q223: Biltz Company uses a predetermined overhead rate

Q299: Twinkle Ornaments Company uses job costing. Twinkle

Q312: How do you calculate the predetermined manufacturing